There are times in the year when we see and engage with more people than usual – through end-of-year functions, annual celebrations, birthdays, anniversaries, weddings, funerals and the like. It can be wonderful – but it can also be stressful. We are quickly reminded that these old friends, colleagues and distant family from far-off shores have opinions that challenge our own, and they’re all too willing to offer unsolicited advice. All these voices can be exhausting […]

Continue readingCategory: Blog

Our emotions tell OUR truth, not THE truth

Did you know that listening to classical music has been proven to lower blood pressure, make us more emotionally available, help us sleep better and relieve anxiety? Ironically, our emotions around money can achieve the exact opposite! Firstly, if money brings up a lot of emotions for you, you’re not alone. Financial expert Ramit Sethi (on a blog for The Harvard Business Review) reminds his readers that our relationship with money is just as personal and […]

Continue readingPolitical influence and the markets

Religion, politics and money are all connected – and probably always have been! This is because they’re all currency for influence, power and status. These three topics can become highly volatile when we’re in social settings as they’re super subjective. The markets, politics and religion all give us a sense of belonging, purpose and stories to share. Since they offer so much meaning, we’ll likely talk about them at any chance. Depending on the crowd we’re […]

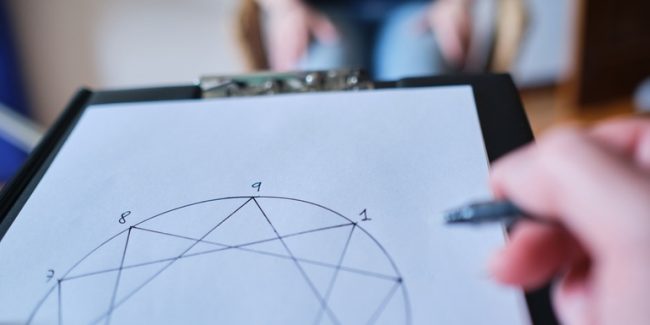

Continue readingCan the Enneagram help you with your money habits?

If you’re not familiar, the Enneagram is a personality typing tool that focuses on why we do what we do. It is a model of nine interconnected personality types – from the Ancient Greek word “ennea” for nine. A quick Google search will tell you what you need to know and guide you to free tests if you’d like to dig a little deeper. Over the last few decades, the Enneagram has grown in popularity, proving […]

Continue readingHoliday-proof your financial plan

Holidays should be a time of restoration and relaxation. But for savvy investors, who are seldom able to switch off or turn down the volume on their analytical brain activity, it can be a time of stress and panic. Whether you’re entering your annual time of leave or it’s a sneaky mid-year break, if you’re understandably nervous about your financial plan, fear not. While no portfolio is fireproof to completely uncontrollable events like black swans and […]

Continue readingCan you control it?

We permanently activate our fight-flight-freeze-appease response when constantly performing at our peak. This acute stress response activates our sympathetic nervous system and keeps us unhealthy or from experiencing deeper joy and fulfilment in life. Blogs and TED talks abound on how we’re living in an age where our stress level is way above a healthy normal, and we need to find ways to reduce our stress to enjoy more of life. Stress can be relieved in […]

Continue readingWhen the conversation goes south…

Despite our best-laid plans and most honourable intentions, conversations about money can go south quickly! There’s never going to be a perfect time to talk about money dreads or financial dreams, but preparing our partner or family for the chat, and finding a space where we won’t be interrupted is always helpful. It’s also helpful to think about what you want to say, but you can never know exactly how others will feel about it. In […]

Continue readingHelping your parents with their financial independence

In the previous blog, we looked at how we can help our children with their retirement, or financial independence, as many in our profession are starting to frame it. But the reality is, as the sandwich generation, we can’t only be thinking about our own and our kids’ financial futures; we also need to be thinking about our parents’ financial futures. Living at a time when fewer and fewer people can afford to live without working […]

Continue readingHelping your kids with their financial independence

We spend most of our time having conversations with people who are 40+ about saving for retirement. However, the language and expectations are slowly starting to shift in a powerful and exciting direction. Instead of only talking about retirement, we’re starting to use words like financial independence. And rather than focusing on traditional milestones, like 65+ years, we’re starting to look at shifting timelines based on goals and lifestyle plans that are based on purpose and […]

Continue readingHow to talk about money

“I love talking about money with my family!” said no one ever. Most of us will agree that there is more to life than money, but regardless, it’s very important for most of us — especially when we feel like we do not have enough. Money can become a consuming focus that leaves us feeling powerless and sometimes even worthless. Talking about money is a helpful way to regain our sense of power and remind ourselves […]

Continue reading